Educating Undergraduates in Private Equity & Venture Capital since 2011

The Wharton Undergraduate Private Equity and Venture Capital Club is the premier place for Penn students interested in exploring the buy-side industry.

Cultivatingthenextgenerationofprivateequityandventurecapitalleaders.

Who We Are

PEVC is a thriving organization of bright and passionate individuals. Our mission is to cultivate connections between private market firms and Penn's students that will ultimately lead to a more professionally prepared and passionate educational community. As a PEVC member, you will acquire and hone vital financial skills, meet and interact with professionals from the industry's best firms, and work and play in a team with the most driven and interesting students Penn has to offer. We are proud to have led Wharton Council's “Best GBM Program” (2023), organized the “Best Event” (2023), and had the “Most Outstanding Board Member” for 2 years straight (2024, 2025).

Our Committees

Students in this team will develop skills in sourcing and investor relations. CO works to develop relationships between PEVC club members and professionals in the industry. Not only will you increase the club's visibility and learn more about the industry, but you will also build personal connections and will be able to point to tangible experiences.

Students in this team will develop skills in financial analysis. Note that both IA and CO will receive the same educational material during the joint session. IA students will develop pitches for potential PE and VC targets, building a keynote pitch and an associated financial model. These will be presented during joint session to the broader club with questions on your approach and assumptions.

Students in this team will have a great opportunity to apply theoretical skills learned in classes and clubs to the real world. This team provides pro-bono consulting services to local entrepreneurs looking to sell their businesses, learn how to position their businesses for a sale, or gain a better understanding of their businesses' value. Students will practice valuation skills (LBOs, DCFs, merger models), build pitch books, and gain a better understanding of valuing and pitching companies. This is for sophomore and up.

This GBM team will have a 100% acceptance rate. In this program, members will come to weekly meetings to learn from our board members, alumni and each other about a wide array of topics. Members will have the opportunity to participate in stock pitch competitions and present on a relevant private equity/venture capital topic. Applicants not selected for any committee are welcome to join the Academy.

What We Do

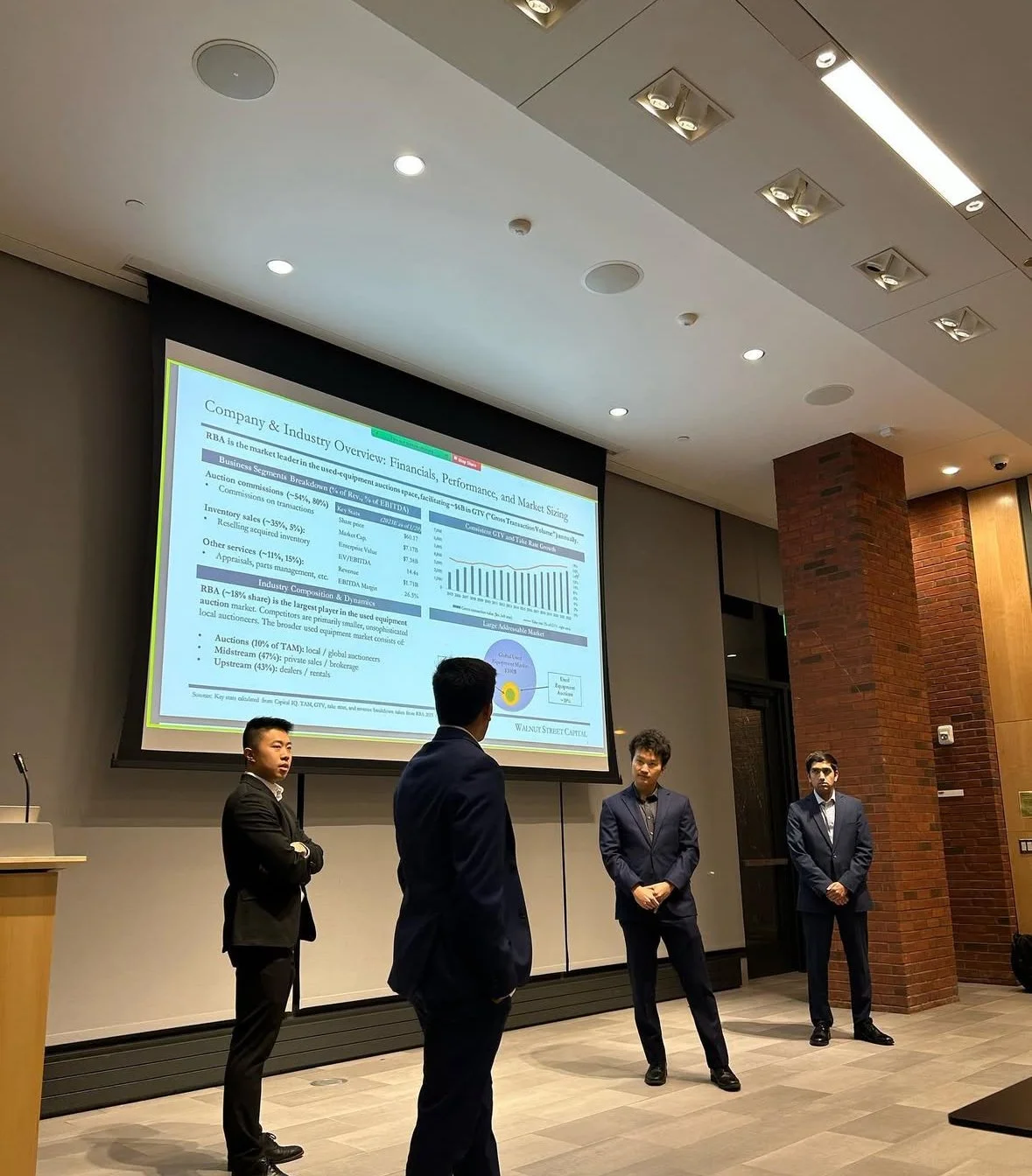

Case Competitions

Wharton PEVC organizes competitions with premier firms for students nationwide. These events let students apply their expertise and engage with industry professionals.

Prior partnerships have included KKR, Silver Lake, Warburg Pincus, and Altamont.

What We Do

Industry Speakers

We host multiple speaking events featuring seasoned PEVC professionals, often in senior leadership roles.

Past speakers represent firms such as Apollo Global Management, KKR, Goldman Sachs, Moelis, Silver Lake, Warburg Pincus, Blackstone, Insight Partners, Apax Partners, Carlyle and more.