* The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

As of 22 Jan 2023 – Current Price: $18.95 | Target Price: $32.78 | Implied Upside: 72.9%

By Eshaan Doke, Vishakh Arora, Oliver Zhang

Description:

In light of the pandemic, companies face a market that increasingly uses remote purchases, and have had to digitize traditional methods. A company currently undergoing this transformation is Thryv (NASDAQ: THRY).

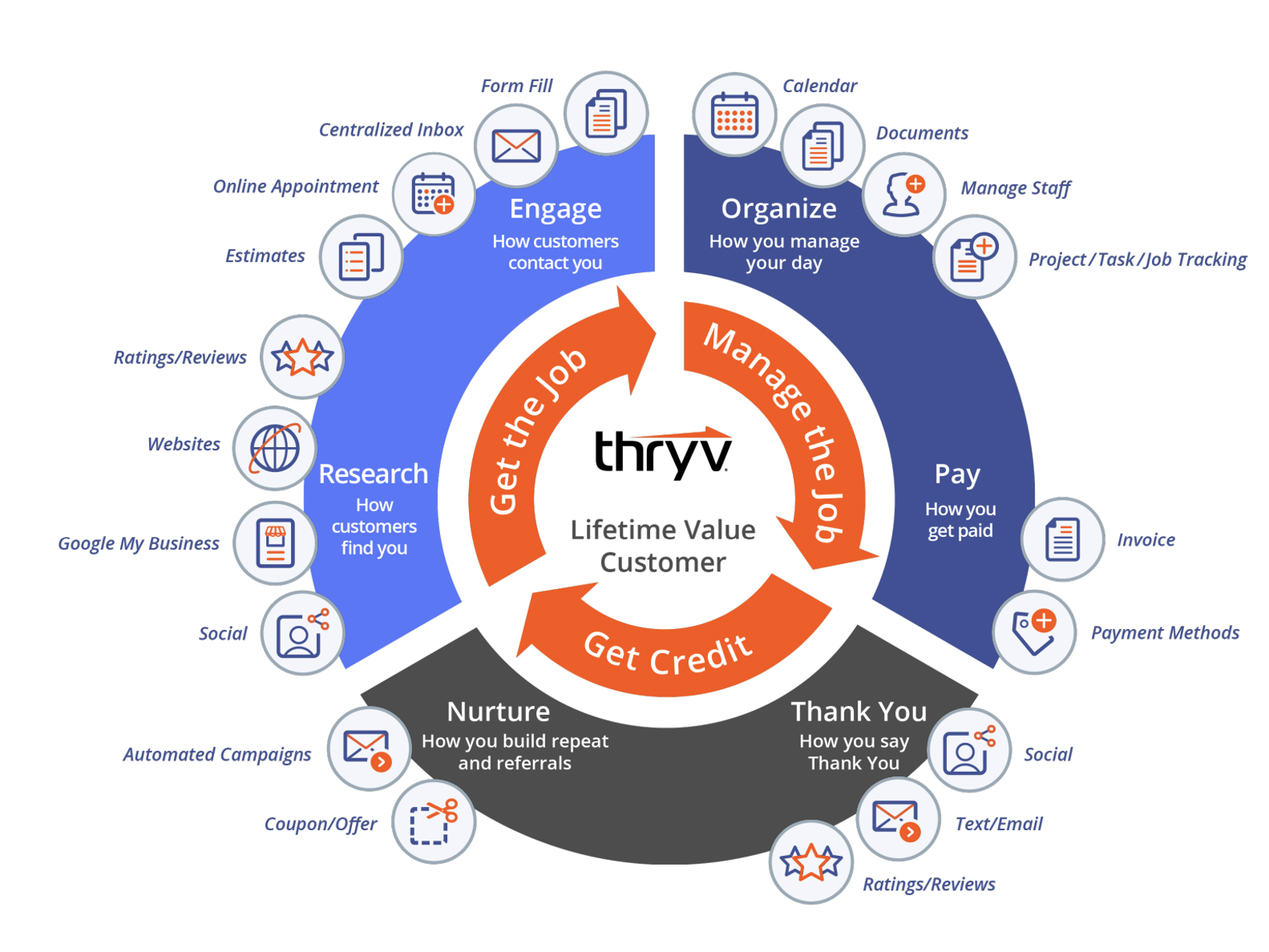

Thryv is a legacy SMB marketing services incumbent transitioning to a SaaS CRM model. Thryv’s SaaS business includes Thryv’s CRM software for invoice and quote management, marketing automation, project management, omnichannel customer communication, appointment scheduling, payment processing, and online presence management. It has 3 main products: Hub by Thryv, which manages day-to-day operations and franchises by linking reporting locations into one UI; Thryv Leads, which is a ML for ad placement and acquiring new customers, which improves lead quality and quantity; and ThryvPay, which processes credit card and ACH payments for SMBs to facilitate rapid transactions.

They are priced the lowest among competitors, and are superior at acquiring, cross-selling, and upselling customers. This is because they are using cash flows from legacy marketing services to fund the transition, and tapping into their sticky customer base to sell the new product. This product works, as clients report 86% revenue increase and 61% appointment booking increase.

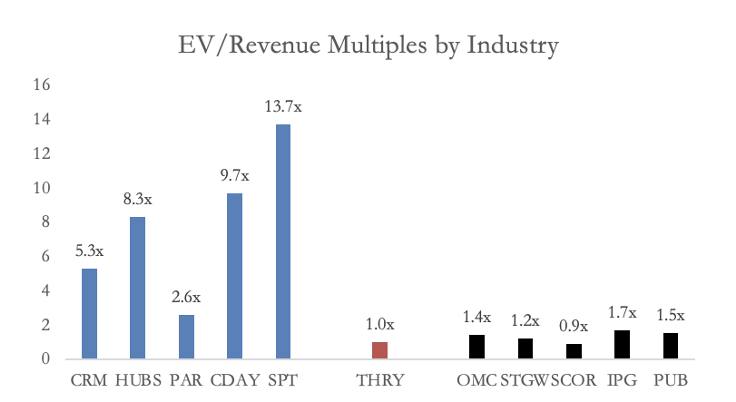

However, this transition is underappreciated due to its nascency. Thryv is misclassified as “Marketing and Advertising” in GICS alongside defunct legacy providers, and trades at a 1x multiple as opposed to the SaaS CRM industry average of 8x. As SaaS revenue share grows (currently 15%), this mispricing will be corrected.

Industry Overview:

Thryv operates within the SaaS CRM industry, which consists of social media monitoring, customer service/experience management, as well as analytics and marketing/salesforce automation. This market is expected to grow at a 12% CAGR to 2030, reaching $58.5B in 2030. Thryv specifically targets the SMB space, and per an industry survey of SMBs, 77% of SMBs need an SMB platform with all the tools in one place, and 64% want to buy these only from one provider. Thryv estimates its SMB target market is 4M out of 31M SMBs in the US & 8M out of 70M SMBs globally.

Within this industry are several tailwinds. First, there is a growing digitization initiative as more focus on digitizing marketing efforts leads to greater extracting of customer insights from large data sets using ML. Second, increased churn and attrition forces SMBs to focus on retaining customers and onboarding, which necessitates stronger SMB-centric SaaS CRM solutions.

Headwinds in the industry include the macro environment. The recession brings about corporate thrift. Short-term decreases in marketing spend are probable amidst a recessionary environment and slowing onboarding of new customers to CRM, though subscriptions are minimally impacted. Second, the rise of vertical specific SaaS with embedded CRM and payment solutions increases competition for industry agnostic SaaS CRM like that Thryv provides.

Investment Thesis:

The market values Thryv as a legacy print marketing services provider and not a SaaS CRM company, in part due to misclassification and zero analyst coverage. Thryv’s SaaS segment is still ramping up and is projected to grow at a 22.1% CAGR to 2030 after experiencing 22.4% growth in FY2021. Projections suggest the SaaS segment will overtake the marketing segment in mid 2025. Thryv’s SaaS segment’s growth is being underappreciated due to the nascency of the transition and zero bulge bracket analyst coverage. Moreover, Thryv is misclassified as “Marketing and Advertising” in GICS alongside defunct legacy providers instead of with SaaS CRM providers in ”Software Automation.” As SaaS revenue share grows by 2025 (currently at 15%), this mispricing will likely be corrected with the market gaining confidence too late.

Legacy marketing services customers serve as a large base of SMBs to cross-sell and upsell to for at least the next 5-7 years. 400,000 legacy marketing services customers form base to be cross-sold. Their M&A strategy boosts cross-sell opportunities while increasing technological prowess. Also, the Sensis acquisition at ~4.5x EBITDA brings 100,000 Australian customers to cross-sell. Even assuming a 9% penetration rate, Thryv can sell SaaS offerings to 9,000 Sensis customers. With a 2022E ARPU of $410 that is $43.2M in revenue. Recent opening of regional HQ in Toronto and partnership with Canadian Franchise Association brings access to 1.5m new SMBs. Currently, roughly 20,000 (~5%) of legacy marketing customers have been cross-sold to SaaS, meaning another 5-7 years of efficient cross-selling will occur. Diverse and more relevant SaaS offering provide more room to upsell THRY’s strategy is to first sell Hub by Thryv and then upsell customers other automation tools such as ThryvPay and marketing center tools like Thryv Leads ARPU increase of 16.9% (2020) and 29.3% (2021) demonstrate upsell ability Thryv’s continuous addition of new modules in their SaaS suite mean more upsell opportunity, with three new modules set to be released from 2023 to 2025.

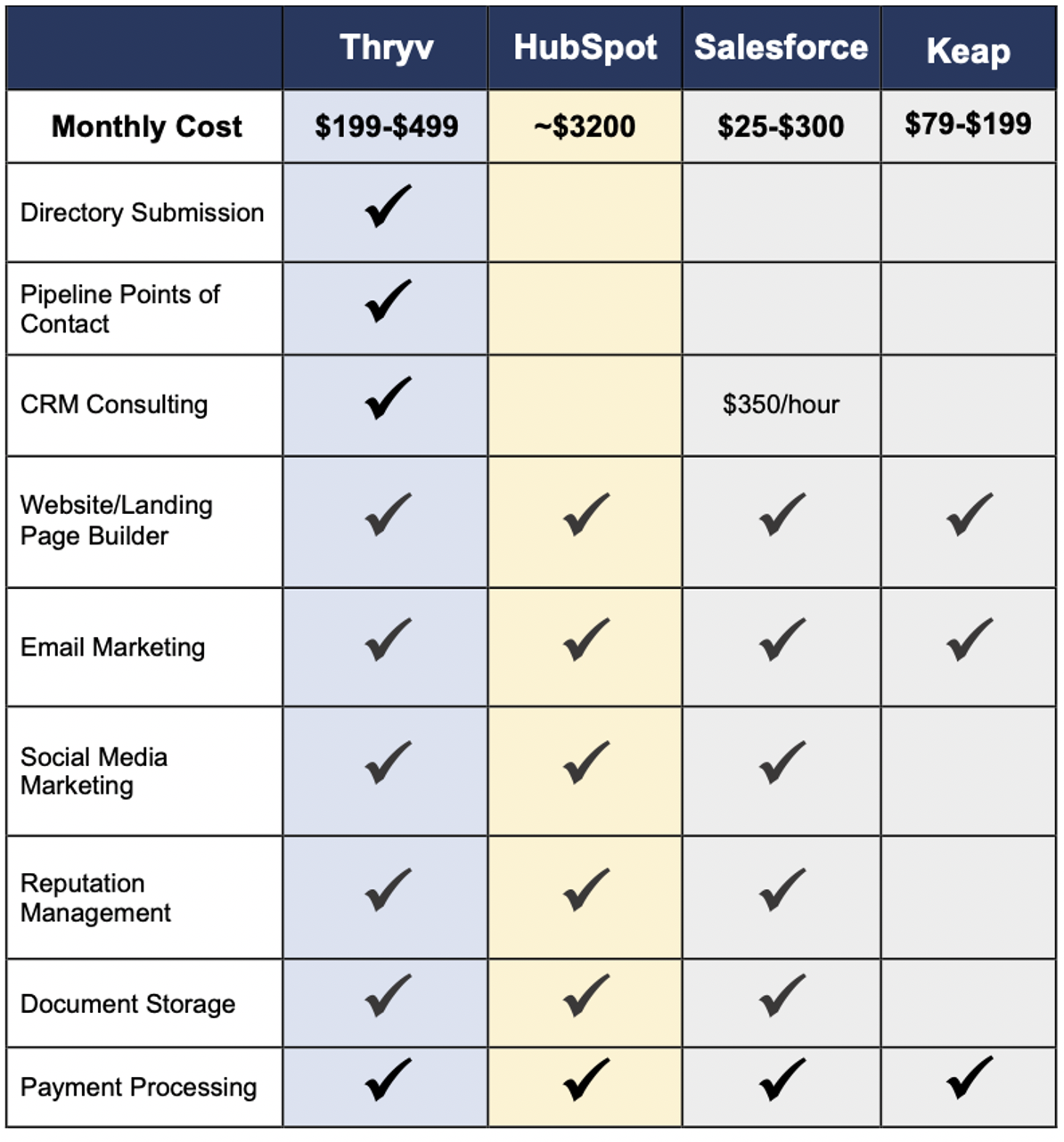

Thryv’s superior product tailored to SMBs is priced at the lowest end of the range, and converting legacy customers minimizes customer acquisition costs. Thryv provides the widest range of offerings, which makes it best tailored to SMBs. G2 rates Thryv significantly above average in all categories, including Overall Product, Quality of Support, Ease of Use, and Ease of Setup (Thryv: 9.2, 9.3, 8.9, 8.8; CRM Average: 8.0, 8.6, 8.6, 8.5). While CRM products are not significantly differentiated technologically, Thryv maintains an edge by bundling directory submissions with other offerings, which appeals most to SMBs. Also, Thryv is priced at the lower end of the range. Note that Salesforce and Keap are priced per user per month, distorting the true figure as Thryv’s offerings can be used by up to 10 users. Thryv’s net dollar retention of 92% is comparable to that of competitors (Salesforce: 91%, Hubspot: 110%). Thryv’s LTV/CAC is 3.2, compared to Hubspot’s 2.1 and Salesforce’s 1.9. This is in part because Thryv saves ~25% in marketing costs when converting legacy customers. This sales efficiency translates into higher margins for Thryv. Finally, Thryv’s EBITDA margin of 28% is higher than Salesforce’s (12%) and Hubspot’s (2.5%) and will increase with scalable SaaS revenue.

Valuation/Assumptions:

WACC of 12.8%

Marketing Services Customers and ARPU decline by 10% and 3.8% in 2022 and at slightly slower decaying rates afterward.

SaaS Customer growth at 5% for 2022 and peaking at 9% around 2026 to account for macro and increased onboarding; SaaS ARPU increasing to reflect upsell and introduction of new modules.

Conservatively flatlined Thryv International Revenue and COGS (37%), since SaaS transition lowers COGS and boosts margins.

Implied share price of $32.78, which reflects a 72.9% upside to the current price of $18.95.

Catalysts:

In October 2022, Thryv announced the launch of their Marketing Center, presenting a new opportunity to upsell/cross-sell customers.

Management plans to acquire marketing services companies to expand their domestic client base and enter new markets internationally in the following years.

In October 2022, Thryv announced Canadian headquarters and began offering ThryvPay to Canadian SMBs, a market with 1.5 million businesses. They expect revenue growth from this to play out in 2023.

Risks and Mitigants:

Creating Thryv’s ecosystem does not improve churn

SMB SaaS becomes increasingly commoditized with plug-in solutions